About Opportunity Zones

The Opportunity Zone Program

Opportunity Zones are a new community development tool established by Congress in the federal Tax Cuts and Jobs Act at the end of 2017. The program seeks to spur economic development and job creation in low-income and rural communities nationwide by providing tax benefits to long-term private investments.

Instead of dedicating taxpayer money to developing thousands of low-income census tracts across the U.S., this program aims to stimulate the investment of the estimated $6.1 trillion of unrealized private gains held by U.S. households. In exchange for investing in communities within qualified Opportunity Zones, investors can access capital gains tax incentives both immediately and over the long term. All of the underlying incentives relate to the tax treatment of capital gains, and all are tied to the longevity of an investor’s stake in a qualified Opportunity Fund, providing the most upside to those who hold their investment for 10 years or more.

How are Opportunity Zones Created?

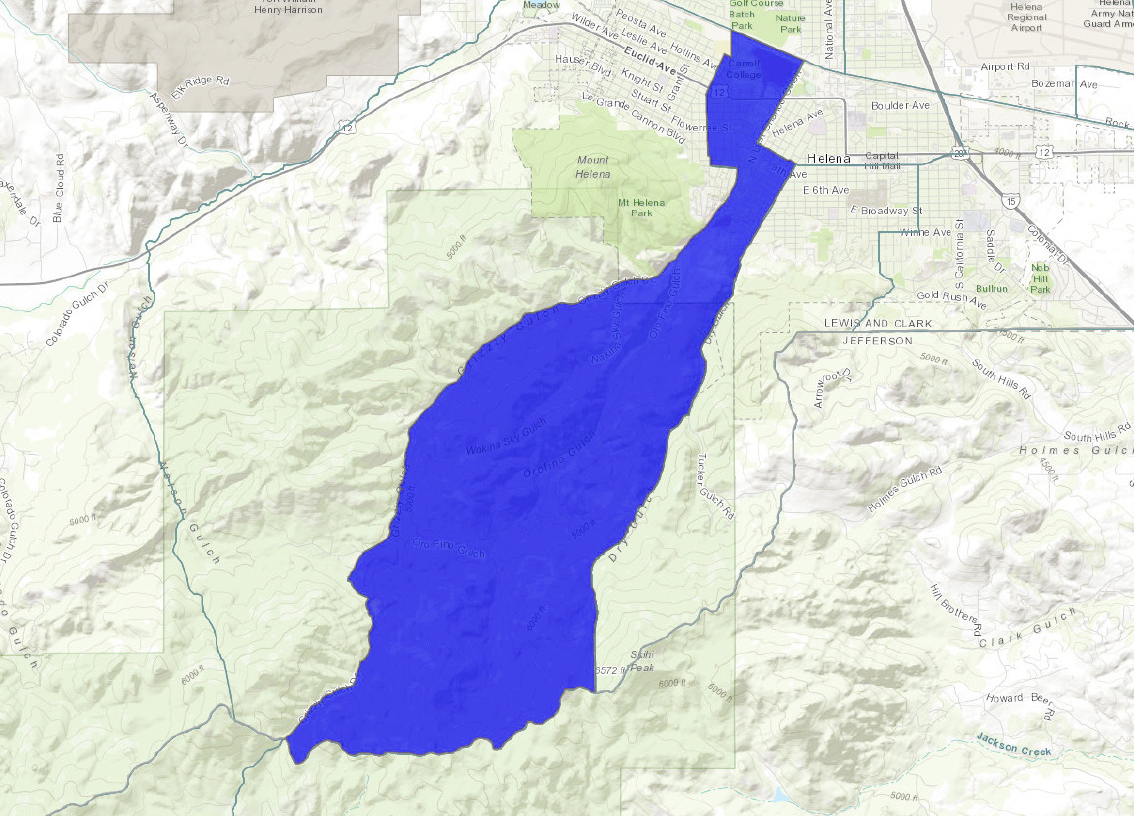

Opportunity Zones are created through a nomination and designation process. Following the passage of the 2017 tax reform, governors of U.S. states and territories were given until April of 2018 to nominate qualifying census tracts in their jurisdictions for Opportunity Zone designation. Areas with a poverty rate of at least 25 percent were eligible to be nominated. Montana Governor, Steve Bullock, nominated 25 census tracts across Montana for designation as Opportunity Zones. All 25 nominated areas were later approved by the U.S. Treasury Department. Helena’s opportunity zone is situated in its historic downtown area.

Helena's

Opportunity

Zone

Investing in Opportunity Zones

In exchange for investing in Opportunity Zones, investors can access capital gains tax incentives available exclusively through the Opportunity Zone program. To access these tax benefits, investors must invest in Opportunity Zones, specifically through Opportunity Funds. A qualified Opportunity Fund is a U.S. partnership or corporation that intends to invest at least 90% of its holdings in one or more qualified Opportunity Zones. Because the Opportunity Zone program is intended to stimulate positive growth within designated communities, there are restrictions on the types of investments in which an Opportunity Fund can invest. These investments are called “Qualified Opportunity Zone property,” which is defined as any one of the following:

- Partnership interests in businesses that operate in a qualified Opportunity Zone.

- Stock ownership in businesses that conduct most or all of their operations within a qualified Opportunity Zone.

- Property, such as real estate, located within a qualified Opportunity Zone.

Tax Advantages of Investing in Opportunity Zones

TEMPORARY DEFERRAL

By moving realized capital gains into a qualified Opportunity Fund within 180 days of the asset sale, investors can defer paying capital gains taxes on that gain until December 31, 2026 or until they sell their Opportunity Fund investment – whichever is earlier. Deferring their tax liability allows investors to put a greater amount of capital to work for a longer period of time. Funds that otherwise would have been used to pay taxes upfront can instead be invested and earn returns for several additional years.

STEP-UP IN BASIS

If an investor holds their Opportunity Fund investment for at least 5 years prior to December 31, 2026, they can reduce their deferred capital gains tax liability by 10% through a step-up in basis. If that investor holds their Opportunity Fund investment for 2 additional years, they can reduce their deferred capital gains liability by another 5%. That means that by holding an Opportunity Fund investment for 7 years prior to December 31, 2026, an investor can reduce their tax liability on the deferred capital gains invested in the Opportunity Fund by 15%.

PERMANENT EXCLUSION

If an investor holds their Opportunity Fund investment for another 3 years (10 years total), they can expect to pay zero dollars in capital gains taxes on any appreciation from their original Opportunity Fund investment. That’s because Opportunity Fund gains earned from Opportunity Zone investments can qualify for permanent exclusion from the capital gains tax if the investment is held for at least 10 years.